Earlier this year, we issued our updated advice on the Annual Allowance (AA) for the current tax year 2022/23. We identified that this tax year was likely to see increased levels of higher AA charges being generated; and that this arose artificially and solely down to rising inflation levels.

We have been lobbying on your behalf within NHS circles, with Health Departments and the UK Treasury to ensure that the anticipated AA problems can be stopped.

We have been lobbying on your behalf within NHS circles, with Health Departments and the UK Treasury.

We are pleased to say that, in the Secretary of State’s Plan for Patients an announcement was made that will largely mitigate against these problems.

What is the solution?

A solution has been proposed by the Department of Health and Social Care (DHSC) that will cover England and Wales. Governments in Scotland and Northern Ireland have indicated an intention to follow suit.

The solution involves delaying the date at which the pension scheme will revalue a career average (such as the 2015 NHS Pension Scheme) or dynamise the earnings of a practitioner’s pension (such as the 1995 or 2008 NHS pension schemes for practitioners).

In a typical year we would expect revaluation or dynamisation events to occur on 31 March 2023. This time there will be a delay of roughly one week so that they occur in the next tax year (2023/24).

Assuming the Government maintains its long-held practice, the level of pension revaluation or earnings dynamisation will be 11.6% (equal to the rate of CPI as of September 2022, which is 10.1%, plus an extra 1.5%).

What is the impact?

By delaying these revaluation/dynamising events until early in the next tax year:

- There is no pension growth associated with revaluation or dynamisation in the 2022/23 tax year. There will still be pension growth based on the NHS Pension you build up over the course of that tax year (which will be 1/54th of your earnings)

- HMRC allows for some linked inflationary growth of a pension. The solution outlined means that HMRC’s allowance for inflationary growth in 2023/24 will be 10.1% which is better aligned with the revaluation/dynamisation given in that year. This means that there will be no artificial increase in AA charges.

DHSC has indicated that this new practice of delaying the revaluation/dynamisation will be maintained beyond 2023.

An example of the impact of this is that for a member with £12.5k in an NHS Pension as of April 2022, with pensionable earnings of £100k per annum, NHS Pension Growth over the tax year 2022/23 will decrease from £50,000 (prior to this intervention) to £23,000 (after this intervention).

DHSC has indicated that this new practice of delaying the revaluation/dynamisation will be maintained beyond 2023. There are further discussions to be had on the exact application of this proposal and what potential pitfalls it may present.

An NHS Pension Scheme member anticipating retirement between 31 March 2023 and the delayed date in early April, may wish to consider delaying retirement until after this later date to avail of the full level of pension revaluation. We will keep you updated as we seek to discuss, further understand, and resolve any such pitfalls in ongoing discussions.

Supporting you with your pension

Whilst we welcome this announcement, it is only one aspect of the complex and punitive area of the taxation of NHS Pensions. We are also committed to continuing discussions on mechanisms that will make the NHS Pensions Scheme more amenable to allowing members the ability to mitigate any exposure to pension tax charges.

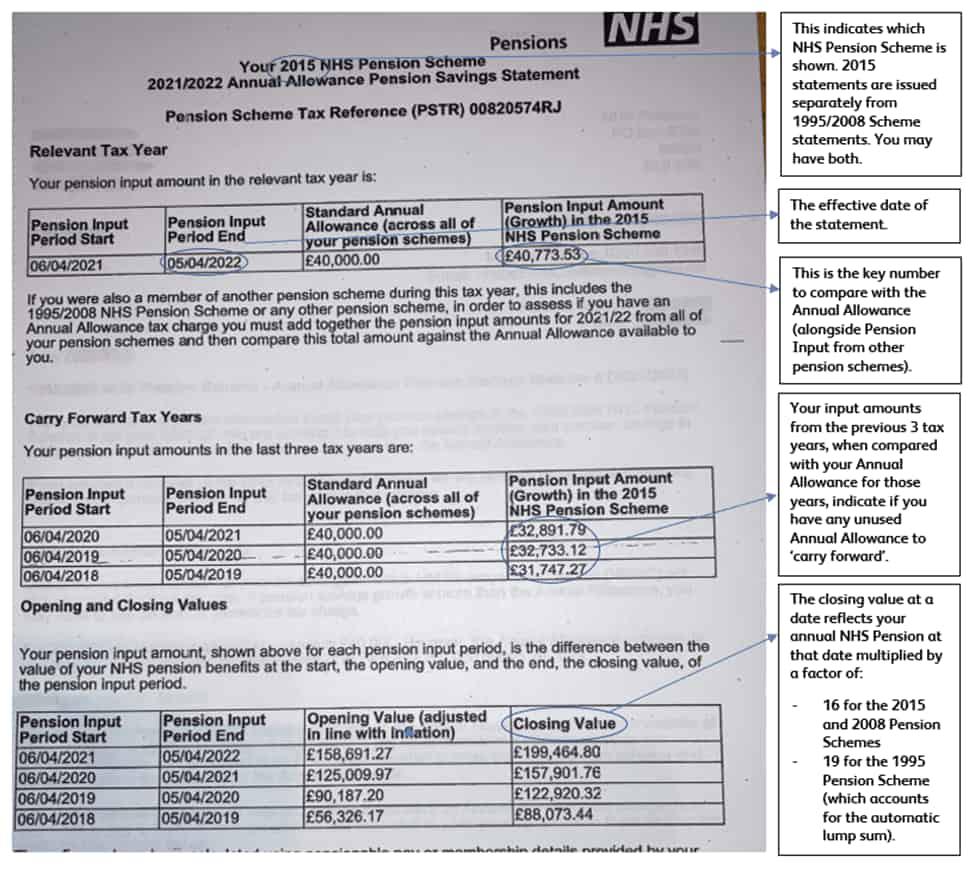

Many members will now be receiving information from their NHS Pension Scheme to outline pension details. An example statement (issued by NHS Business Services Authority in England and Wales) below has been annotated to highlight what the information contained in your statement means. Statements issued in Scotland and Northern Ireland will look different.

It is important that this information is shared with your accountant and/or financial advisor. If you have not yet received a statement but believe you should have, you can contact your relevant pension scheme through these links – England and Wales, Scotlandor Northern Ireland.